Fighting for the UK manufacturing. Meeting the challenges of the future

An in-depth analysis of the challenges and opportunities facing the UK manufacturing sector, including the impacts of Brexit, COVID-19, and the adoption of Industry 4.0 technologies.

The Current State and Future Potential of UK Manufacturing

The UK manufacturing sector stands at a pivotal moment. Economic pressures from Brexit and the COVID-19 pandemic have exposed its vulnerabilities. At the same time, transformative opportunities such as Industry 4.0 offer pathways to resilience and innovation. This analysis delves into the sector’s current challenges, potential growth areas, and the technological advancements shaping its future.

The Economic Footprint of Manufacturing in the UK

Manufacturing remains a cornerstone of the UK economy. In 2022, it contributed £217 billion in output, representing 45% of total UK exports—a figure that amounted to £275 billion. Beyond these direct contributions, manufacturing drives innovation, accounting for 47% of the nation’s business R&D expenditures. When factoring in its supply chain effects, manufacturing’s total GDP impact reached £518 billion, equating to 23% of the UK’s GDP, as outlined in data from the Office for National Statistics.

However, the sector’s growth has slowed, with manufacturing output falling by 0.6% from September to October 2024. While projections estimate a recovery with a 0.8% growth rate in 2025, this figure remains only half the broader economic growth forecast, according to the Manufacturing Outlook report by Make UK.

Regional disparities also play a significant role. The North West leads with £32.5 billion in output, whereas Northern Ireland lags behind with £8.9 billion. These differences underscore the need for targeted strategies that address specific regional challenges, as detailed in the Make UK Regional Analysis.

Challenges Stemming from Brexit

Brexit’s effects have introduced a range of non-tariff barriers that disrupt trade. Although the Trade and Cooperation Agreement avoided tariff-based restrictions, non-tariff barriers have eroded competitiveness. This has particularly affected small and medium-sized enterprises (SMEs), which struggle to navigate increased documentation and delays, as highlighted in the Centre for Economic Policy Research review on Brexit’s impact.

Specific industries, such as agri-food and textiles, have seen the greatest impact, grappling with compliance requirements and customs processes. To mitigate these effects, manufacturers are reconfiguring supply chains, including reshoring production and diversifying supplier bases—a strategy that may increase resilience over time, as examined in a study on advanced manufacturing sectors by TandF Online.

Lessons from the COVID-19 Pandemic

The pandemic further exposed the fragility of manufacturing supply chains. Many firms faced operational halts due to global disruptions. Nonetheless, the crisis accelerated the adoption of digital technologies. Industry players began leveraging real-time data analytics, automation, and digital twins to anticipate disruptions and adapt quickly, according to findings in a study published on ResearchGate.

In the post-pandemic landscape, resilient supply chains and diversified sourcing strategies remain top priorities. Companies are increasingly prioritising domestic sourcing and technological investments to insulate operations from future crises.

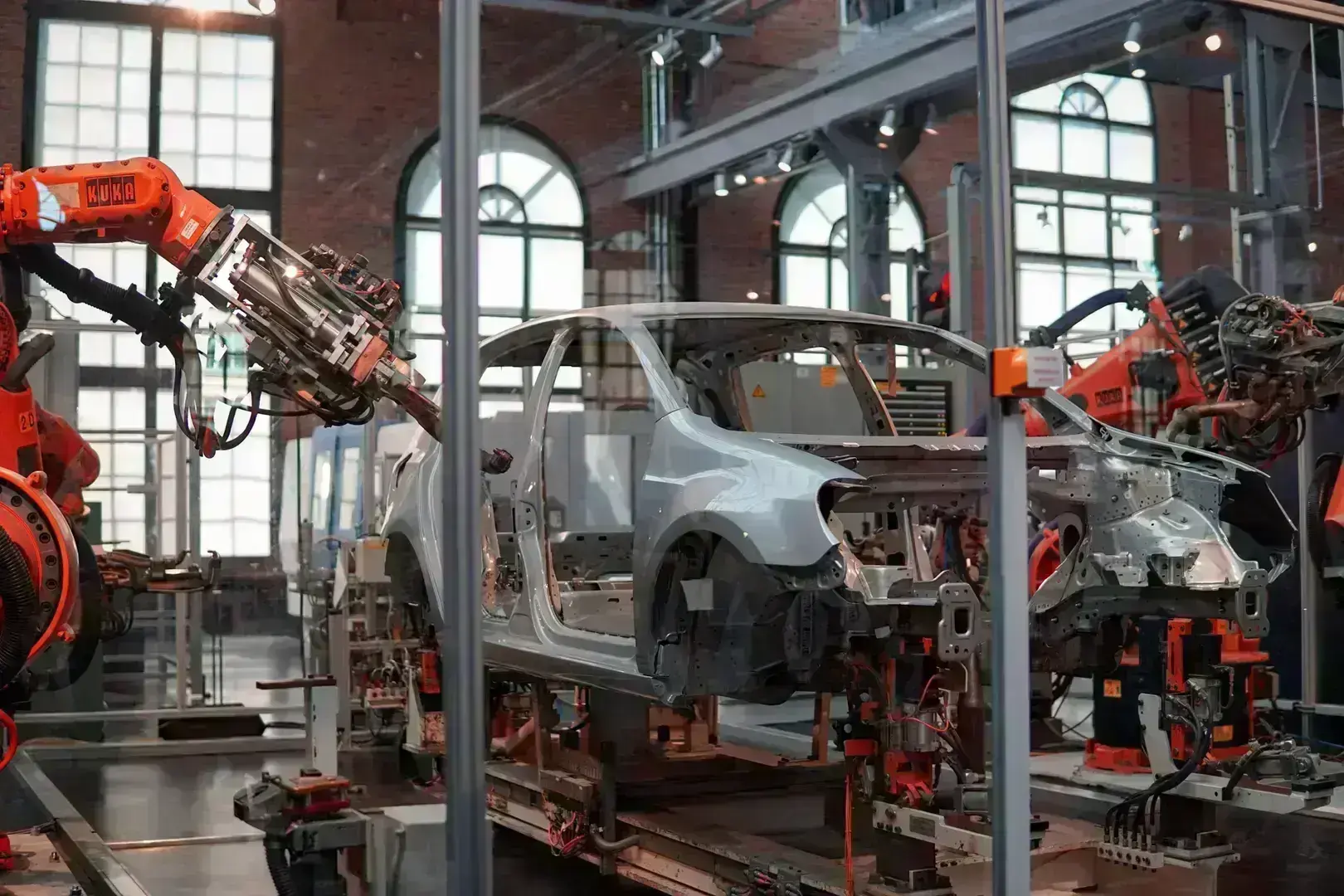

Industry 4.0: A Revolution in the Making

Industry 4.0—defined by the integration of digital and physical technologies—offers a lifeline for UK manufacturing. Technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), and advanced robotics promise substantial productivity gains and cost efficiencies. However, the adoption of these technologies remains uneven across the sector.

Key Technologies Driving Change:

- IoT: Connected devices streamline operations by providing real-time monitoring and predictive maintenance capabilities, as detailed in an MDPI review on manufacturing sustainability.

- AI and Machine Learning: Advanced algorithms enable quality improvements, fault detection, and production optimisation.

- Additive Manufacturing: Also known as 3D printing, this technology simplifies the production of complex components, reducing lead times and costs.

- Robotics: Collaborative robots (co-bots) enhance human-machine workflows, taking on repetitive tasks while allowing workers to focus on higher-value activities.

Despite these benefits, only 25% of UK manufacturers report a clear understanding of Industry 4.0’s implications. Many cite a lack of strategic direction and insufficient workforce skills as barriers, according to KPMG’s analysis of manufacturing strategies.

Addressing the Skills Gap

The UK’s manufacturing workforce faces a persistent skills gap. With 36% of vacancies unfilled due to inadequate skills, this challenge hinders productivity and innovation, as outlined in Make UK’s Workforce Insights.

Reskilling and upskilling initiatives are essential. Programmes such as lifelong learning and apprenticeships can bridge the divide, equipping workers with digital and technical expertise. Moreover, proactive workforce planning ensures alignment between talent supply and technological demand, as highlighted in the McKinsey report on reskilling in the UK.

Future Outlook: Seizing Opportunities

To secure its future, the UK manufacturing sector must navigate these challenges with decisive action. Strategies include:

- Accelerating Digital Adoption: Government incentives for digital transformation could spur broader uptake of Industry 4.0 technologies.

- Reconfiguring Supply Chains: A focus on localisation and diversification builds resilience.

- Enhancing Education and Training: Collaborative efforts between industry and academia ensure a steady pipeline of skilled workers.

- Investing in R&D: Public and private investment in cutting-edge research positions the UK as a global leader in manufacturing innovation.

By embracing these pathways, UK manufacturing can transition from a crossroads to a position of global competitiveness. The journey requires collaboration across stakeholders—government, industry leaders, and the workforce—but the rewards promise a resilient, innovative, and prosperous future.

Contact us.

If you need a partner in software development, we're here to help you.

We will respond to your enquiry immediately.